Definition

Invalidity Benefit is paid to an Insured Person who is:

- Incapable of work otherwise than as a result of Employment Injury,

- Has been so incapable for a period of not less than twenty-six (26) weeks; and

- Likely to be permanently so incapable

Qualifying Conditions

An Insured Person is entitled to Invalidity Pension if he / she:

- Is an Invalid (as defined in item one (1) above);

- Has paid not less than one hundred and fifty (150) Contributions;

- Has paid or been credited with, or has paid and been credited with, not less than two hundred and fifty (250) Contributions;

- Is under sixty- (60) years of age; and

- Is not in receipt of Sickness Benefit.

An Insured Person who does not satisfy the previous Qualifying Conditions, but who:

- Is an Invalid (as defined in item one (1) above),

- Has paid not less than fifty (50) Contributions; and

- Is under sixty (60) years of age,

- becomes entitled to an Invalidity Grant.

Rate of Benefit

The Weekly Rate of Invalidity Pension is thirty percent (30%) of the Relevant Wage, supplemented by one percent (1%) of that wage for each fifty Contributions in excess of two hundred and fifty (250) Contributions. The Weekly Rate must not exceed sixty per cent (60%) of the Average Insurable Earnings, nor be less than forty percent (40%) of the existing Minimum Wage.

To Calculate the Rate of Pension:

- Obtain Contribution Record for at least five (5) years before commencement of Invalidity,

when Insured Person paid at least thirteen (13) weeks / three (3) months Contribution annually (1 year = 12 months before month of commencement of Invalidity). - Find the 'best' three (3) years in the five (5) years mentioned in item (1), where the 'best' year means the year with the highest Annual Insurable Earnings.

- Invalidity Credits are then calculated by subtracting the age of the Invalid at his / her last birthday before commencement of Invalidity, from 60.The difference is then multiplied by 25, and the resulting amount is the number of Invalidity Credits to which the Insured Person is entitled.

The Invalidity Credits are then added to the number of paid and credited Contributions, to give the total number of Contributions. - The Annual Insurable Earnings for the 'best' three (3) years is summed.

- The number of Contribution Weeks for the 'best' three (3) years is summed.

- Divide item (4) by item (5) to get the Average Weekly Insurable Earnings.

- Weekly Pension: (30% of item (6)) + (1% of item (6)) for each group of fifty- (50) Contributions in excess of two hundred and fifty (250) Contributions.

- Monthly Pension: (Weekly Pension x 52) ÷ 12.

To Calculate the Grant Payable:

- Where the Insured Person is entitled to an Invalidity Grant, the sum payable is equal to one twelfth (1/12) times the Average Annual Insurable Income for each group of fifty- (50) Contributions, whether paid or credited or paid and credited.

- Obtain total Contribution Record.

- Sum the Insurable Earnings for all the years of Contributions

- Sum the Contribution Weeks for all the years of Contribution

- Divide item (11) by item (12). This gives the Average Weekly Insurable Earnings

- Multiply item (13) by 52, to give the Average Annual Insurable Earnings

- Divide the total number of Weekly Contributions by 50, which gives the number of groups of fifty- (50) Contributions

- The amount of the Grant payable, would be equal to 1/12 x Average Annual Insurable Earnings x Number of Groups of fifty- (50) Contributions.

Duration of Benefit

Invalidity Pension is payable to the Insured Person for as long as Invalidity continues, or until the attainment of age sixty- (60) years, where an Old Age Pension maybe paid.

Invalidity Grant is a single payment to the Insured Person.

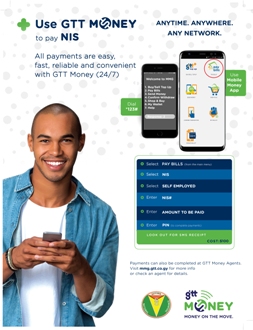

Method of Payment

Invalidity Pensioners are issued with "Pension Order" Books, which contain six (6) Benefit Payment Vouchers to be encashed on a monthly basis. New Books are prepared and issued upon submission of "Life Certificates", which attest to the Pensioner being alive.

Recipients of Invalidity Grant are issued with a single Benefit Payment Voucher.

Vouchers can be encashed at National Insurance Offices, Post Offices and some Commercial Banks.

Manner of Claiming

A Claim for Invalidity Benefit must be made by completing and submitting Form INVB1 - Claim for Invalidity Benefit to the nearest National Insurance Office.