Definition

Old Age Benefit is payable to Insured Persons who have attained the age of sixty- (60) years. The Benefit can be in the form of a Periodical Payment (Pension) or a Grant (lump-sum).

Qualifying Conditions

To qualify for an Old Age Pension, the Insured Person must have:

Paid not less than one hundred and fifty (150) Contributions.

Paid or been credited with, or paid and been credited with not less than seven hundred and fifty (750) Contributions.

Attained the age of sixty (60) years.

To qualify for an Old Age Grant, the Insured Person must have:

Paid not less than fifty (50) Contributions.

Attained the age of sixty (60) years

Rate of Benefit

Old Age Pension

The weekly rate of Old Age Pension is 40% of the relevant wage, supplemented by an additional 1% of that wage for each group of fifty Contributions in excess of seven hundred and fifty (750) Contributions.

To Calculate Rate of Pension:

Obtain Contribution Record for last five (5) years worked before age sixt- (60) years, when the Insured Person paid at least thirteen (13) weeks / three (3) months Contributions annually.

Obtain best three (3) years in the five (5) years mentioned at item (a).

Sum the Annual Insurable Earnings for 'best' three (3) years.

Sum the number of Contribution Weeks for 'best' three (3) years.

Divide item (c) by item (d) = Average Weekly Insurable Earnings.

Weekly Pension = (40% x item (e)) + (1% x item (e)) for each group of fifty- (50) Contributions in excess of seven hundred and fifty (750) Contributions.

The Rate of Pension however, must not be less than 50% of the existing Public Service Minimum Wage, nor greater than 60% of the Average Weekly Insurable Earnings.

N.B: One (1) year refers to twelve (12) months before the birth month of the Insured Person.

'Best' year means the year with the highest Annual Insurable Earnings.

Old Age Grant

Old Age Grant is a lump-sum payment equal to one-twelfth (1/12) times the Average Annual Insurable Earnings for each group of fifty (50) Contributions, whether paid or credited or paid and credited

To Calculate Grant:

Obtain the total Contribution Record.

Obtain the Annual Insurable Earnings for each year of Contribution.

Sum the Annual Insurable Earnings for all the years of Contribution.

Sum the number of Contribution Weeks for all the years of Contribution.

Divide item (c) by item (d) = Average Weekly Insurable Earnings.

Multiply item (e) by 52 = Average Annual Insurable Earnings.

Grant = 1/12 x item (f)x Number of Groups of fifty- (50) Contributions (in total Contribution Record).

N.B: One (1) year refers to a Calendar Year.

Duration of Benefit

An Old Age Pension is paid to the Insured Person, for as long as he / she is alive.

An Old Age Grant is a single payment

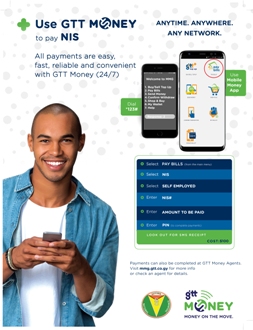

Method of Payment

Old Age Pensioners are issued with "Pension Order" Books, which contain six Benefit Payment Vouchers each. These Payment Vouchers become eligible for encashment on a monthly basis. New books are prepared and issued upon submission of "Life Certificates", which attest to the Pensioner being alive

The recipient of an Old Age Grant is issued with a Single Benefit Payment Voucher.

Manner of Claiming

A Claim for Old Age Benefit must be made by completing Form OAB1 - Claim for Old Age Benefit. This Form must be taken to the nearest National Insurance Office, along with the Insured Person's Birth Certificate, Social Security Card and National Identification Card.