Definition

Industrial Death Benefit is payable to the Dependants of a Deceased Insured Person who died as a result of an Industrial Accident.

Qualifying Conditions

- There are no Contribution Conditions to be satisfied by the Insured Person. However, the Dependants of the Deceased Insured Person must satisfy specific conditions in order to qualify for the Benefit.

The Dependants of the Deceased Insured Person who are entitled to claim Industrial Death Benefit are:

(a) The Widow of the Deceased, if at the time of his death:

i) She is over forty-five (45) years of age or incapable of work, and this incapacity is likely to be permanent; or

ii) She is pregnant by her late Husband; or

iii) She has the care of a Child of his or their Marriage under eighteen (18) year of age, and was either residing with him or receiving, or entitled to receive from him, periodical payments for the maintenance of herself or the children or both.

(b) The Widower of the Deceased if at the time of her death:

i) He is over fifty-five (55) years of age and incapable of work, and this incapacity is likely to be permanent; and

ii) He has no income from any source whether by way of Pension or otherwise, other than Public Assistance under the Poor Relief Act or Non-contributory Pension under the Old Age Pensions Act.

(c) Every Unmarried Dependent Child who becomes an Orphan as a result of the death of:

i) An Insured Person due to an Industrial Accident

(ii) A Widow or Widower in receipt of Death Benefit and who has no Stepmother or Stepfather with a prior Claim.

(d) A Parent of the Deceased who is permanently incapable of self-support, and who was being wholly or partially maintained by the Deceased, or who would, but for the Accident, have been so maintained;

(e) Where there is no Widow, Widower, Child or Parent, other Dependants who are members of the family of the Deceased, and who were wholly or partially maintained by the Deceased or would, but for the Relevant Accident, have been so maintained:

i) If the Dependant is a man, he must be permanently incapable of self-support;

ii) If the Dependant is a woman, she must be permanently incapable of self-support, or is living with her Husband who is permanently incapable of self-support;

iii) If the Dependant is a child, he/she must be under the age of eighteen (18) years or, if over that age, is permanently incapable of self-support.

If there is more than one Dependant, the amount payable shall be distributed in such a manner, as the General Manager may consider reasonable.

(f) Where there is no Dependant entitled to Death benefit, the smaller of the following amounts shall be payable to the Creditors or Estate of the Deceased Insured Person:

i) A sum equal to the reasonable expenses for Medical Attendance on the Deceased for the Relevant Injury, and the reasonable expenses of his/her Burial; or

ii) The sum of two hundred and fifty dollars ($250).

Rate of Benefit

The Weekly Rates of Death Benefit Payable are shown below:

| Beneficiary | Basic Rate | Increase For Each Dependant | Maximum Benefit Payable |

| Widow | 35% of the relevant wage | 11 2/3% of the relevant wage | 70% of the relevant wage |

| Widower | 35% of the relevant wage | 11 2/3% of the relevant wage | 70% of the relevant wage |

| Orphan | 23 1/3% of the relevant wage | 23 1/3% of the relevant wage | 70% of the relevant wage |

| Parent | 35% of the relevant wage | 11 2/3% of the relevant wage | 70% of the relevant wage |

- Where the Benefit is payable as a lump sum (to Dependants at item (e)), the amount shall not exceed one hundred (100) times the Relevant Wage, nor be less than two thousand seven hundred dollars ($2,700.00).

If the lump sum payable results in the award to an individual Beneficiary of an amount exceeding sixty- (60) monthly payments of the Minimum Pension, then an Annuity or Periodical Payment would be made.

Duration of Benefit

- Death Benefit is payable to:

(a) A Widow, from the date of death of her Husband for life, provided that:

i) If she remarries or cohabits with a man not her Husband, her Basic Rate of Benefit, but not the increases already awarded for her Dependants, shall cease from the date of her remarriage or cohabitation;

ii) If she remarries, she shall be entitled to a Gratuity on termination of her Basic Rate of Benefit, of an amount equal to 52 times the Weekly Rate of the Basic Benefit to which she was then entitled, but not of the increases already awarded in respect of her Dependants.

(b) A Widower, from the date of death of his Wife for life, or

i) Until he is declared by a Medical Board to have become capable of work; or

ii) Until the General Manager is satisfied that his circumstances have been changed by remarriage or otherwise, that he no longer fulfils the conditions at item 2 (b) above.

(c) An Orphan, from the date of death of his/her surviving Parent until the age of sixteen (16) years. Payment will continue beyond age sixteen (16) if the Orphan :

i) Is between the ages of sixteen (16) and eighteen (18) years and is an Unpaid Apprentice, and not otherwise employed for gain, or is receiving full-time education; or

(ii) Is unmarried and permanently incapable of work.

(d) A Parent, from the date of death of the Deceased for life or:

i) Until the General Manager is satisfied that the circumstances of the Parent have changed by remarriage or otherwise, that he/she would no longer have been dependant on the Deceased Person if he had survived.

Method of Payment

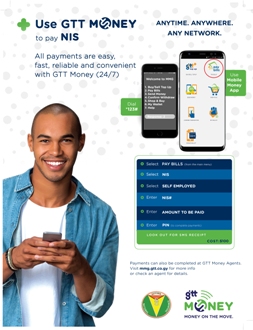

Recipients of Death Benefit are issued with "Pension Order" Books, which contain six (6) Payment Vouchers to be encashed on a monthly basis. New Books are prepared and issued upon submission of "Life Certificates" which attest to the fact that the Pensioner is alive.

Vouchers can be encashed at National Insurance Offices, Post Offices and Commercial Banks

Manner of Claiming

A Claim for Death Benefit must be made by completing the Form IB15 - Claim for Death Benefit, and submitting it to the nearest National Insurance Office.

The Claimant must also submit supporting documents such as the Death Certificate of the Deceased Insured Person, Marriage Certificate (if Claim is made by Spouse) and Birth Certificates of Children under eighteen (18) years.